Why is still wild west for home services marketplaces?

Jan 24, 2025

For years, we’ve both worked at home services tech companies When people asked what our companies did, we’d try different lines, sometimes emphasizing the tech—“An app making it easy to hire great local pros.” Other times the user problem: “Home maintenance is hard, but we make it easy to find good people to help.”

No matter how we explained, though, once the concept clicked, the response was almost always the same: “Ohhhhh, you’re like the AirBNB (or Uber, or Etsy...) of home services!”

To which we’d usually just smile and say, “Yep, exactly.” But it was always tempting to say more.

That sort of comparison works well in shorthand, but it hides an interesting story. After all, why isn’t there an AirBNB or Uber—that is, a dominant, well-known, tech leader—in home services, a massive industry, in 2025?

Consider, for example, that nearly 90% of travel bookings now happen online, without any human interaction. In home services, on the other hand, we see roughly 70% of hires now are assisted by online tools. If you add a qualification of a booking or hire “without human interaction,” you reduce that rate much further, by more than half. The adjacent, tech-driven industries we were always compared to are actually far ahead in terms of ability to buy, book, and pay directly in-app.

On the surface, this huge difference should be surprising given 1) hundreds of millions of dollars invested over 20+ years in many well-run tech companies to improve home services hiring; and 2) the size of the prize. Home services in the US is growing roughly twice as fast as the economy overall and already represents a ~$600B+ industry. (For comparison, that’s about 5 - 10x bigger than the US short-term travel rentals industry, according to most industry analysts).

In today’s post, we’re indulging in a little history lesson, exploring home services marketplaces past and present, and why there isn’t a clear winner still, even after everyone from the biggest global companies to dozens of start-ups have taken turns at bat. This is a big subject, so we’ll just scratch the surface with our take.

A (very) brief look back at the start

It’s the mid-90s. Most online services hiring was happening, albeit slowly, through print directories like the Yellow Pages—unless you were fortunate enough, as the saying went, to know a guy (or to know a guy who knows a guy).

That’s when Angie Hicks tried to hire a contractor and realized it’s silly hard. Surely there’s a better way? She goes on to build the first, well-known online home services hiring tool, Angie’s List.

Around the same time, Craigslist emerged, and those who used it to make home service hires (myself included) remember it as a wild west, where anyone and everyone could post any job or service-for-hire. It was a dramatic contrast to Angie’s pay-walled garden of curated reviews.

Let’s make some brand soup

Over the next 15 years, that same simple realization—the local services industry is huge, and it’s too damn hard to find and hire good pros—inspired many similar start-ups hoping to lead a tech-based takeover: ServiceMagic (later renamed HomeAdvisor), Porch, Thumbtack, Handy, Houzz, TaskRabbit, Red Beacon, and many, many others.

It’s worth pausing here. As we noted earlier, the companies mentioned above collectively represent hundreds of millions of dollars invested in improving home services hiring, but arguably none of them has achieved the brand recognition enjoyed by the two original lists, Angie’s and Craig’s, in their hay days. (It’s telling, for example, that after Angie’s List merged with Home Advisor, by far the bigger company by revenue, they eventually rebranded as Angi.)

It’s a surprising state, given these huge investments and the tremendous progress made by a few key players in most other major, tech-driven marketplaces industries. So, back to the original question: Why hasn’t there been a clear winner?

Pick your poison: Broad and general, or narrow and precise

There’s an old saying in philosophy that a single idea can describe a wide range of phenomena generally, or a specific phenomenon precisely. But a single idea can’t explain a wide range of phenomena precisely.

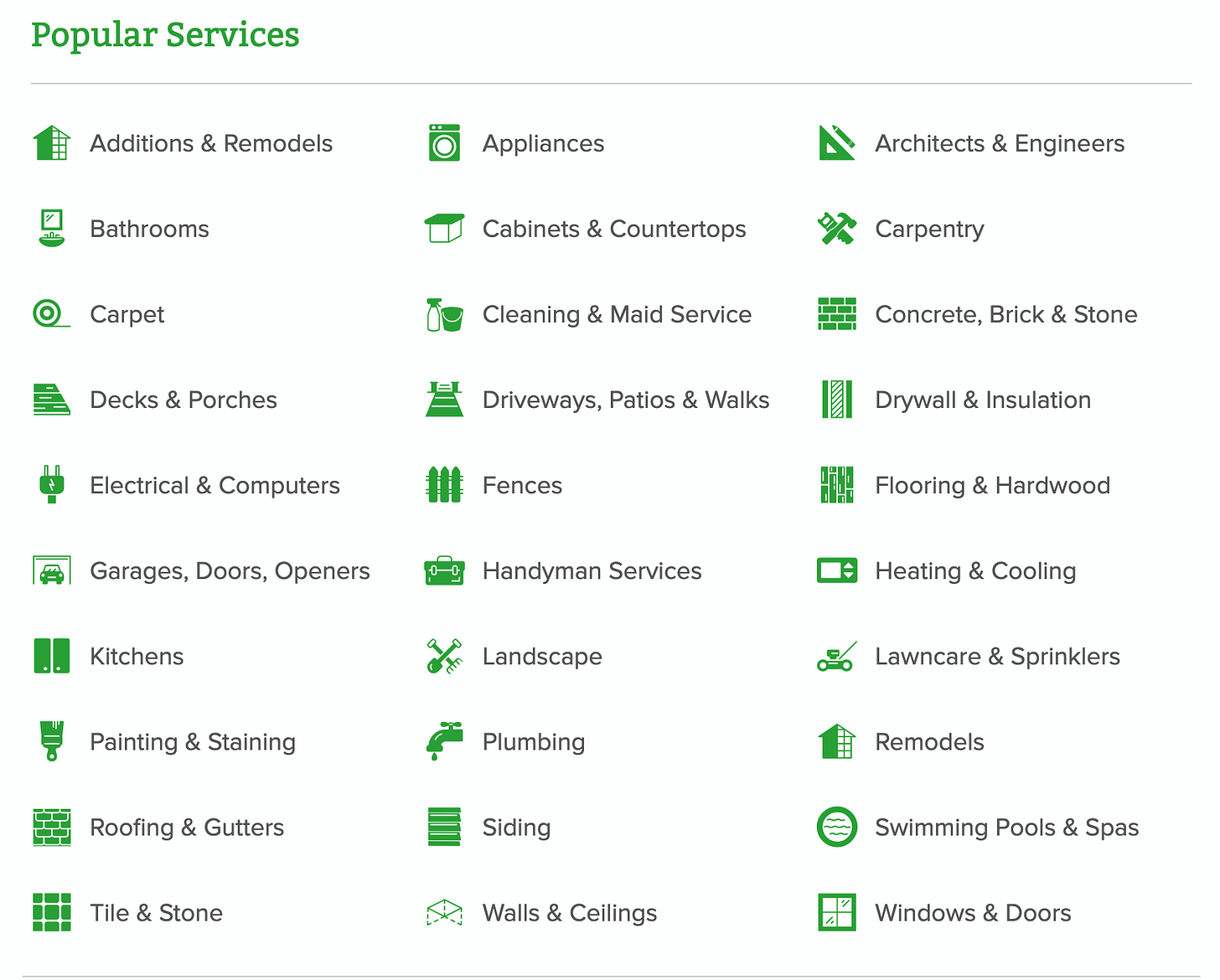

There’s a parallel here for home services marketplaces. On the surface, their aspiration seems relatively straightforward. But when you try to move beyond a general Yellow Pages-like directory to actual hiring online with limited or no human interaction, the aspiration bends under the weight of dozens of precise use cases and categories.

For example, hiring for junk removal is entirely different in scoping, pricing, and credentialing than summer lawn-care or emergency plumbing. Even more, many home projects resist categorization: you discover a worrisome crack in a ceiling and need it inspected and repaired. Or you want to replace trim around exterior windows. Or you need a new porch railing. Forget about booking and paying: what type of service pro are you even looking for?

On the supply side, home services marketplaces face another significant challenge: highly fragmented markets made up of specialized, local businesses across every major category—everything from fly-by-night “Chucks in trucks” to sophisticated national franchise networks.

The upshot: “tech-ifying” home services becomes an exercise in building and managing hundreds of categories, each with its own standards (if it has them at all), as well as complex networks of service pros with vastly different levels of sophistication.

This inherent complexity is why, in our view, home services marketplaces are actually a sort of meta-marketplace (and inherently much more complex than most other “parallel” marketplaces we were compared to). It’s also why, to date, even the most advanced companies have typically just connected home owners through various mechanisms to local pros to work out the details, rather than directly facilitating hiring and booking. (That said, there’s building consensus at this point that the eventual winner(s) will make most services directly bookable up-front—something we may explore later).

This complexity is the primary reason no one has been able (yet) to make home services hiring as simple as, say, vacation-rental booking. It’s also led to a proliferation of players, and more arriving every year. Given the number of competitors, we think it can be helpful to simplify the current competitive landscape into a few clusters.

The Generalists

These are the players with the big, bold aspiration to change the home services industry at large with a single approach, much like Angie’s List set out to do almost 30 years ago. Key players include Angi (Home Advisor, Angie’s List, Handy), Thumbtack, and Porch, as well as a host of start-ups and international entrants trying to make inroads in the US every year, like Bark, Airtasker, and Urban Company.

Their goal is a one-stop app covering every major home service category. It’s home management in your pocket. The winner here could become the primary gateway for the $600B industry.

However…

These companies have also struggled to build category-specific precision across the many home use cases, and they’re usually not as nimble as the Verticalists (described below). In addition, the quality and depth of the local businesses they merchandise, as well as the hiring and payments options themselves, can vary dramatically from one category and city to the next.

It can also be hard for home owners to tell the Generalists apart on first visit. Check out the home pages of the key players, and you can be forgiven for thinking they’re all built from same template (As a starting point: Angi, Thumbtack, Bark).

As a result, the majority of the market continues to by captured by word of mouth and search engine and search ads. The largest marketplace player by far in this cluster is Angi, who captured perhaps 4% of the overall GMV in home services, with overall revenue of $1.89B in ‘22. (By contrast, Porch reported ‘22 revenue of $275M)

It’s tempting to believe one or two generalists will eventually “verb” the home services industry, but after 25 years and many, many attempts, it’s perhaps just as reasonable to look at a few of the other clusters if you’re betting on an eventual winner(s).

The Verticalists

These players have zoomed in on precise categories within home services, like lawn care or pet services or kitchen renovations, where they can build deep supply and more precise hiring and booking experiences than the generalists typically can. Of course, for the home owner or user, this comes with one significant drawback: a different app for every major project type.

There are far too many players and industries to name here, but the most successful Verticalists (at the risk of stating the obvious) tend to cluster around an easily differentiated service or user journey. A few standouts, for illustration:

-

Houzz, the most general of the verticalists, so to speak, focused on home renovation and design inspiration as its focus. It’s estimated at ~$340M in annual revenue.

-

Homeaglow has grown well in house cleaning. While they’re a private company, third-party estimates suggest they’ve achieved ~$75M in annual revenue.

-

TaskEasy built its business on lawn care and green services (and was recently aquired by WorkWave). While it’s financials aren’t publicly shared, third-party estimates suggested annual revenue in ‘22 of around $60M.

It can be tempting to write off the Verticalists as too niche to be influential on the industry at large (and vulnerable to an eventual winning Generalist approach), but it’s worth noting that key Verticalists have in several cases grown as fast as many of the Generalists and achieved similar revenue run-rates (excluding Angi).

The Giants

Given the size of the prize, it’s not surprising that several tech giants also launched local services marketplace plays. What has been surprising, however, at least to us, is that most have struggled to make significant headway (though for familiar reasons).

-

Amazon launched Amazon Home Services in 2015, with a goal that could have been pulled from any of the Generalist’s PR decks: “In less than 60 seconds, customers can now browse, purchase, and schedule hundreds of professional services,” across around 700 categories. At the time of its launch, most wouldn’t have bet against Amazon, given the depth of its pockets and the strength of its brand. But it soon ran into the same challenges as the Generalists, leading it to eventually and simplify its aspirations dramatically (at least for now). At time of writing, Amazon Home Services has a much humbler scope, primarily related to “Installation, Assembly, and Haul-Away Services”.

-

Facebook also jumped in with its own Home Services Marketplace strategy in 2018, once again with familiar aspirations: “Provide an all-in-one place to complete your next home project — from proposal to completion.” Facebook’s initial strategy, however, did differ in one interesting way. They took a sort of, no pun intended, meta-approach, choosing to work with companies like “Handy, HomeAdvisor, and Porch” to source providers for Facebook users’ projects. Ultimately, though, Facebook also scaled back its aspirations, arriving at a similar place as Amazon, with little to no app real estate dedicated to local services in its current Marketplace.

-

Google officially started testing its own competing product also in 2015, originally called “Google Home Services.” Later changed to “Google Local Services,” the program quickly expanded. Given its unique advantages, Google’s approach deserves a more detailed breakdown, so for now we’ll just note 1) the program is a threat to any Generalist or Verticalist that can’t create a sticky app experience 2) is growing fast, having expanded beyond home services, including a recent addition of five huge new categories.

The Expanders

The final category in our overview centers on a group of well-known companies whose initial products were adjacent to local services and who in recent years have looked to add local services marketplaces or direct bookings engines to their core products—each with varying degrees of success:

-

Yelp is the prime example of a marketplace expanding into home services. Originally started all the way back in 2004 as an app to find great places to eat, Yelp began expanding into Home Services in the ‘10s. By 2017, 20% of its $850M in total revenue came from Home Services, and it had started to expand its home services product with features like “Request a Quote,” which took cues from Thumbtack’s Request a Quote model at the time. In 2022, Yelp’s Home Services continued to grow faster than the rest of its business.

-

Not to be forgotten, two major retailers have also added home services marketplaces. Most prominently, Home Depot has built a local services offering, including most notably through the purchase of Red Beacon in ‘12, hoping to expand on its retail traffic and build partner revenue. It’s notable that its home page now looks much like the generalists’ home pages. Similarly, IKEA acquired TaskRabbit, a more Verticalist-style, handyman-based marketplace, in ‘17, to help “expand earning potential of Taskers and [IKEA] connect consumers to a wide range of affordable services.” Growjo estimates TaskRabbit’s current revenue at close to $300M annually.

A final note: Time to place your bets

As many have noted, home services is one of the last, major industries primed but still waiting for an eventual, dominant tech disruptor or two. The prize is huge, and the type of eventual winner(s) we’ll see is far from obvious.

Will you bet on one the Giants or Expanders to take the dominant market-share through acquisitions and better ability to attract the attention of home owners and services businesses alike. Or is your wager that a Generalist will eventually “verb” the industry with an app that changes home maintenance and makes homes services hiring feel easy, safe, and repeatable across a dizzyingly complex range of home categories. Or perhaps the idea of a single home services winner or two is itself far too simplistic for such a complex set of needs, and your money says we’ll continue to see a churn of Verticalists, Generalists, and start-ups kick up the dust for years to come, preventing dominant winners.

We’re excited to contribute to the conversation on this fascinating industry with this and future posts, and as always, we welcome your feedback, comments, and ideas.

Stay connected with the ServiceTrain Newsletter!

Subscribe to get the latest news and updates on the local services products and trends that matter to getting hired, direct to your inbox.

We hate SPAM. We will never sell your information, for any reason.